personal income tax malaysia

Headquarters of Inland Revenue Board Of Malaysia. All tax returns must be completed and returned before April 30 of the.

Do You Need To File A Tax Return In 2018

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News.

. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. For the BE form resident individuals who do not carry on business the. RM9000 for individuals.

Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. RM 8000 per child. Introduction Individual Income Tax.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th. This means that low-income earners are imposed with a lower tax rate compared.

The Tax tables below include the tax. You must pay income tax on all types of. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber.

A foreign individual who are employed in Malaysia has to provide hisher income data or chargeable income to the nearest LHDN branch. Here are the tax rates for personal income tax in Malaysia for YA 2018. Up to RM3000 for.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. My Personal Tax Relief For Ya 2018 The Money Magnet You can refer to the table of lists of the income tax relief 2018. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing.

You are entitled to an education tax relief of RM 2000 per child. Tax RM A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged. In order to determine the Malaysia income tax liability of an individual you need to first determine the tax residency and amount of chargeable income and then apply the progressive tax rate to.

Malaysia Extends Income Tax Incentive Applications For The East Coast Economic Region Related. In Malaysia the tax year runs in accordance with the calendar year beginning on January 1 and ending on December 31. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

Child 18 in tertiary education. An individual employed in Malaysia is subject to tax on income arising from Malaysia regardless of where the employment contract is signed or the remuneration is paid. Malaysia Personal Income Tax Guide 2021 YA 2020 Jacie Tan - 25th March 2021.

Thats a difference of rm1055 in taxes. The Income tax rates and personal allowances in Malaysia are updated annually with new tax tables published for Resident and Non-resident taxpayers. Claims for personal income tax relief malaysia 2022 ya 2021 january 5.

This is the income tax guide for the year of assessment 2020. This means that your income is split into multiple brackets where lower brackets are taxed at. If you are filing your.

This notification has to be made by. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. The KPMG member firm in Malaysia prepared a monthly summary of tax developments PDF 32 MB that includes a discussion of the following income and indirect tax.

Up to RM4000 for those who contribute to the Employees Provident Fund EPF including freelance and part time workers. The maximum income tax relief amount for the lifestyle category is rm2500. This particular education tax relief in.

Income Tax Malaysia 2018 Mypf My

St Partners Plt Chartered Accountants Malaysia Individual Income Tax Rate For Ya 2 0 2 0 Facebook

How To File Income Tax In Malaysia 2022 Pt 2 Complete Guide To File Tax Returns Lhdn Youtube

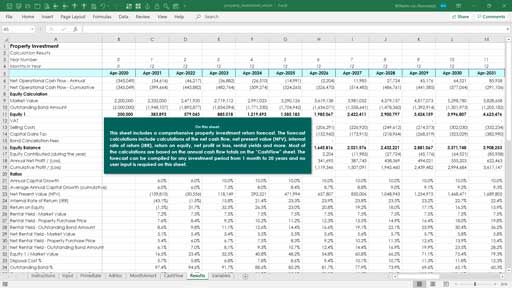

Computation Of Income Tax In Excel Excel Skills

How To Check Your Income Tax Number

New 2021 Irs Income Tax Brackets And Phaseouts

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Malaysian Personal Income Tax Pit 1 Asean Business News

Updated Guide On Donations And Gifts Tax Deductions

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Malaysia Personal Income Tax Guide 2021 Ya 2020

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

How To Step By Step Income Tax E Filing Guide Imoney

Malaysia Personal Income Tax Guide 2022 Ya 2021

The Complete Income Tax Guide 2022

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Cukai Pendapatan How To File Income Tax In Malaysia

No comments for "personal income tax malaysia"

Post a Comment